How to BUY a HOME in 2022

If your goal is to buy a home in 2022, you need to be prepared!

While it is expected that the property market will have more stock than last year in most cities, competition for quality homes will remain strong. To ensure you’re the successful buyer or bidder, you need to start getting organised now.

Here are some tips to help you buy a home over the next 12 months.

Review your budget

Review your budget

Lenders need to know you can pay back what you borrow and they will assess your spending habits as part of the home loan application process. Go through your budget and savings plan so you can prove to your lender how much money you can commit to your mortgage payments.

Interest rates are sitting at record lows but be aware that restrictions around borrowing have changed recently. You need to be able to prove to your lender that you will still be able to make your home repayments when interest rates rise.

If you have any debt in your name, the more you can get rid of as you prepare to borrow, the better. Look at paying off your credit cards or consolidating your debts, and avoid signing up for any buy now, pay later schemes because they will show up in your credit rating.

Think about pre-approval

With your budget sorted out, it is a smart move to get pre-approval for your home loan before you think about making offers.

Once you have pre-approval, you can put in offers with confidence. If you find a home you love but need time to figure out the finance, you’re risking someone who is purchase-ready having their offer accepted ahead of yours.

Pre-approval can take several weeks or even months so the sooner you can start the process, the better.

Consider your purchasing options

When it comes to borrowing, different lenders have different criteria. Make sure you work with a lending specialist who can help you to shop around for a loan that will suit you.

To get into the market as a first time buyer, you might consider ‘rentvesting’ and purchasing a home outside of your ideal area to lease to someone else, or buying with friends or family. These days, many Millennials and Gen Xers are also asking their parents (or other trusted friends or family members) to act as guarantors on home loans. This means that your parents take on the responsibility for repayments if you fall short.

These strategies can all help you to get into the market sooner but consider the pros and cons first, and always have a clear written agreement if you team up with other people to buy.

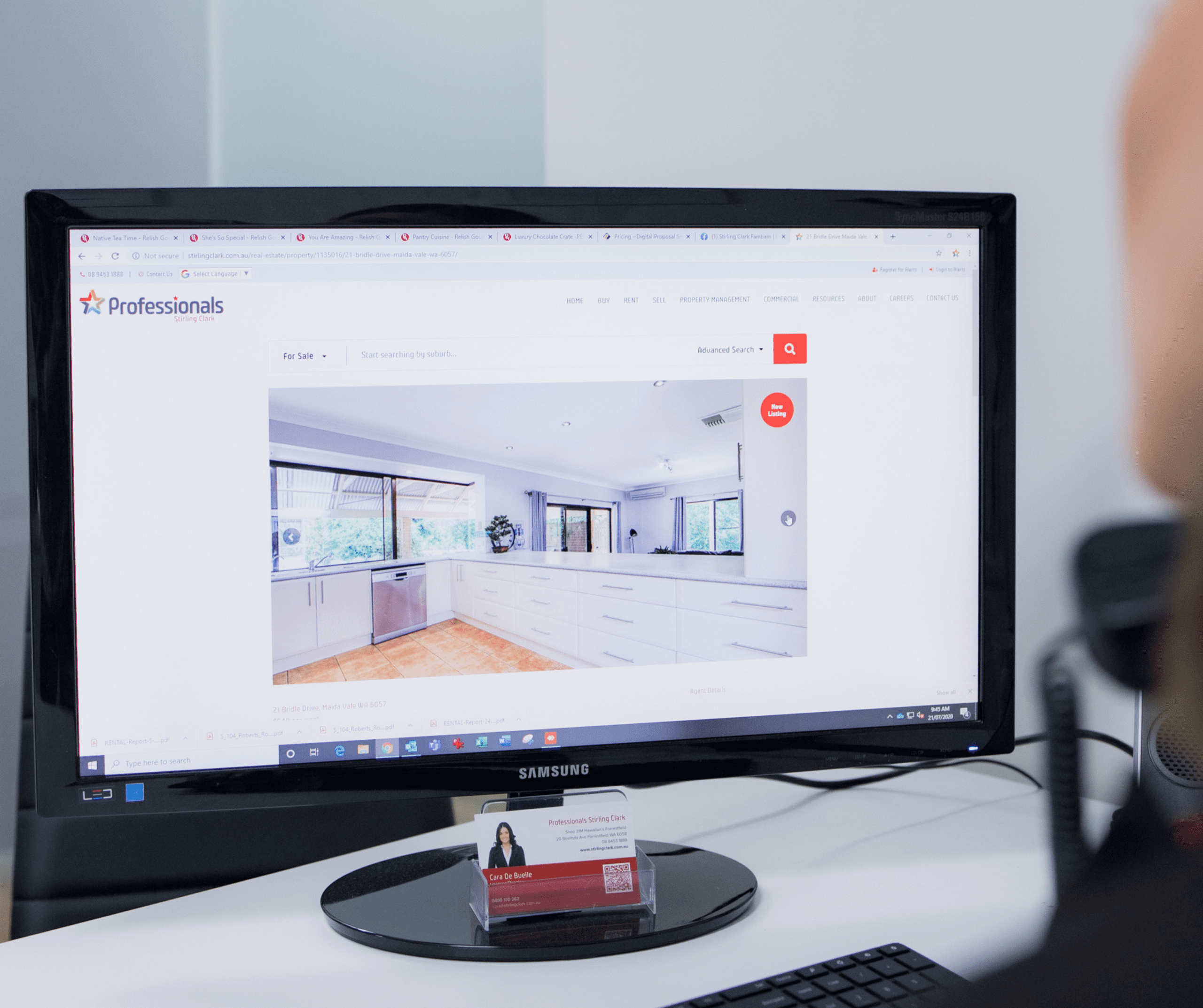

Get to know your local agents

Once you have all your finances and budget sorted out, you need to make friends with the real estate agents who operate in the area where you want to buy.

An agent who knows your budget and what you’re looking for will contact you if a house comes up that meets your brief.

It makes sense to attend open homes and speak with agents while you’re waiting for pre-approval. This way, as soon as you’re ready to buy, you’ll have the contacts you need to help you secure your dream home.